Texas data center markets, including Austin, Dallas, Houston and San Antonio have become some of the most popular locations in the US. According to research by CBRE, the state holds the second position in terms of data center inventory – and demand here shows no sign of slowing down.

Stargate to Invest $500bn in Texas Data Centers

President Donald Trump put Texas at the forefront of innovation in the industry just days after his 2025 inauguration, when he announced a new investment project worth up to $500 billion.

The project, named Stargate, will begin with a $100 billion investment from OpenAI (creator of ChatGPT), Softbank and Austin-based Oracle.

Announcing Stargate at the White House, Trump said it would build “the physical and virtual infrastructure to power the next generation of AI.” It’s said that the project will create 100,000 jobs.

In a joint statement, investors said: “This project will not only support the re-industrialization of the United States but also provide a strategic capability to protect the national security of America and its allies.”

There are already 10 new data centers under construction in Texas, one of which will be the size of Central Park. These new data centers, combined with existing facilities in the state, will rapidly expand data capacity to cope with the ever-rising demand for digital services.

Why Texas?

There are a number of reasons why Texas is so popular amongst data center providers and their customers, and why it was front of mind when plans were first put in place for Stargate.

Firstly, energy costs in Texas are significantly lower than that of nearby states, which means it’s far more affordable for businesses to grow here.

The deregulated market has brought some volatility in the past, but this has led to innovation on a scale not seen anywhere else in the US – and incredible investment in the Texas grid has brought tangible benefits that businesses are now taking full advantage of.

Texas has a wealth of resources, which makes it an attractive place to house a data center. Availability is of little concern here, and a relatively low cost of living in the state makes it a great place to work and live.

The state welcomes new business. It’s a friendly place in which to run a data center, and it’s a great place for the businesses that need those data centers too. Energy companies in Texas are typically helpful, and want to work with new data centers.

Let’s look at some of the key reasons why businesses are moving their IT infrastructure to Texas data center markets, and why Texas continues to lead the way in construction.

Texas Has Affordable Energy Prices

With the exception of some parts of Austin, the energy market in Texas is deregulated. As a result, businesses in Texas enjoy energy prices that are nothing short of outstanding.

Energy prices in Texas are six times lower than they are in California, for example. And that’s just one of the reasons why colocation in Texas is proving enormously attractive to businesses opting for remote setups – and why Texas makes sense as the home of Stargate.

The amount of power required by large data centers can reach 100 MW or more. Per year, that’s a similar amount of energy that would be needed to power 350,000 to 400,000 electric cars – or a medium-sized power plant.

The cost of that energy is therefore hugely important. With relatively affordable energy prices available in much of the state, Texas is a place where investors can really maximise the return on projects like Stargate.

The business-friendly taxation and regulatory environment also work in the state’s favor when it comes to attracting investment of this kind, as does the relative ease with which new facilities can join the grid here.

At our data center, distribution is provided by Centerpoint and there is choice over energy providers. But a word of warning, not all areas of Texas are the same.

In Austin, businesses face a regulated market and a lack of choice, which does mean that power rates can be 50% higher in some areas. Availability is also somewhat reduced in the area, as is access to power.

Outside of the city, choice is far more extensive and data centers are able to capitalise on that, on behalf of their customers.

Our Dallas and Austin data centers provide access to incredibly affordable energy. As an example, we’ve been able to buy energy at an average rate of $0.0334 per kwh so far this year.

The low cost of energy is driven by a number of different factors. To explain, we need to think about the Ercot market and how it works.

The volatility that we’ve experienced in recent years, like the winter storm of 2021 and its resultant power outages, led to huge investment in the Texas grid – and that’s been enormously helpful in terms of reliability.

Battery development and natural gas distributor generation continue to be a focus in the state, with several highly complex and incredibly valuable battery storage projects ongoing.

In July 2024, it was announced that Intersect Power planned to build $837M worth of grid batteries in Texas, with the aim of getting them up and running before the end of the year. The batteries will store solar power from the company’s 640 megawatt Lumina project and its 320 megawatt Radian project, providing additional flexibility to the grid.

Likewise Enchanted Rock is installing, operating and maintaining clean, low-emission generators fueled by underground natural gas. Its generators power on automatically and provide power for prolonged periods.

The combination of the factors we’ve talked about allows us to say, with a degree of certainty, that Texas energy is affordable now – and will continue to be in the future.

The ERCOT Market

Texas is the only individual state that has its own grid. The grid covers 90% of Texas power load, and has over 1,250 power generation units. It manages and monitors over 54,1000 miles of transmission lines. But what’s really impressive is the transparency it offers its customers.

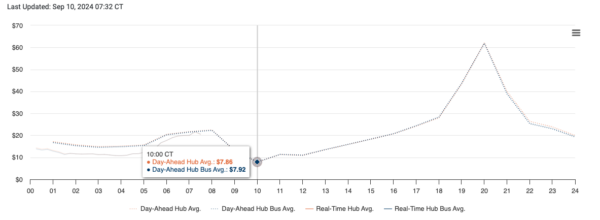

Just take a look at the Ercot website and you can see how rates are changing, what the capacity levels are, and how wind and solar energy is being combined to power the state. Peak load conditions are typically driven by weather events in Texas, and that’s also evident in the graphs provided by the grid.

To understand billing from Ercot, you really need to understand peak demand charges. The demand portion of its bills is based on maximum short-term power draw during a defined period, measured in megawatts. It looks at demand across short intervals of 15 – 60 minutes, within a broader window of time like a one-month billing cycle. Costs are then assigned to the demand, and bills for the following year are based on these calculations. Designing to mitigate peak draws is therefore extremely valuable.

When considering what cost might be in the long-term, it’s always worth looking at climatology first and foremost. Days where temperatures top 100 degrees tend to make a real difference to pricing. Soil moisture reports give a good indication of rainfall, which allows us to see which areas are in drought or suffering extreme dry conditions. And this allows us to predict the impact that weather will have on future energy prices.

Simply speaking, the more rain we get the more resistant we are to those peak temperatures. Bear in mind that events like hurricanes can come in and change the climate with immediate effect.

Texas is Officially the Greenest Grid in US

Data centers consume enormous amounts of power, and that consumption is only going to grow over time. With businesses becoming increasingly reliant on technology to grow, there’s little that can be done to curb this usage. But companies can counteract the effects of their growing consumption by making greener choices.

The energy grid in Texas is officially the greenest in the United States. Recent years have seen considerable investment in solar, wind and battery-storage facilities in the state, leading to a much lower emissions profile that could help to lead the way in the fight against climate change.

Texas set records at the beginning of this year when 70% of the energy Texans used came from wind and solar power. Throw nuclear power generation into the mix and on that same day 83% of the electricity came from non-carbon-emitting sources.

Federal tax incentives have also led to renewable energy trading for free on some occasions, a move that has made and continues to make a real difference to energy bills.

Incredible resources

In Texas, businesses have access to all the resources they need. And it’s all easily accessible from one place. Infrastructure is supporting rapid growth around cities like Austin, Dallas and Houston, and the rise of data centers in these areas is testament to their suitability for such businesses.

Companies opting to relocate to Texas, or invest in data centers in the state, also find no shortage of skilled tradespeople to complete their projects. There are plenty of highly skilled professionals here, from industrial electricians and plumbing/mechanical professionals through to welders, major construction staff, concrete trades and much more.

There’s no need to fly personnel in to complete even the most complex of projects, and of course this also helps to reduce construction costs.

Tax incentives and cost of living

Texas is well known for providing good value, particularly when it comes to things like the cost of living – which have been soaring in recent years.

The affordability of basing businesses in Texas has of course been great news for growth, and it’s also helped to support innovation. We’ve seen huge investment in fiber and its availability recently, with privately funded fiber companies connecting more of Texas than ever before.

There are tax incentives for businesses looking to move to Texas data centers, too. The state currently offers a sales tax exemption on equipment and electricity for data centers of at least 100,000 square feet, as long as they are looking to invest at least $200 million and employ at least 20 people at above-average wages. Additionally, assets are protected from a property tax perspective in Texas.

Why are there so many data centers in Texas?

Texas data centers have an enviable reputation for attracting high-tech energy and technology businesses. The Texas Enterprise Fund awards ‘deal-closing grants’ where a single local site is competing for a project with other out-of-state sites.

The state also offers sales tax breaks for qualifying data centers. And even if you don’t qualify for this exemption, agreements limiting the appraised value of the data center’s property under Tax Code Chapter 313 exist to provide a secondary layer for tax savings for data centers.

No wonder the Lone Star State ties with California for the highest number of Fortune 500 company headquarters in the U.S. Its 346,000 millionaires, the second largest in the nation complete the picture of a stable, successful economy.

The Governor’s University Research Initiative continues to attract Nobel laureates and other major researchers to its state public universities. Consequently, Texas hosts a wide spread of high-tech industries in its Silicon Valley and Silicon Prairie initiatives.

Texas is one of the few states offering flexibility for negotiation and incentives at both state and local levels. But there’s a growth-driven crunch going on in Texas right now, with vacancy at record low levels and demand increasing by the day.

We’d advise any businesses looking to move to Texas data centres to begin making plans sooner rather than later. Because while there are more facilities being built, and more space is being made available, demand has never been so high in the state. Talk to our team if you’d like to find out more about making the move to our Texas data center.

How a Central Location and a High-Tech Culture Attracts Data Centers

Texas has attracted more than its fair share of data centers since the industry began. However, this has recently exceeded expectations as investors target its central U.S. location, skilled workforce, and tax incentives for data center customers.

Michael Lahoud, writing for D Magazine ascribes this to impressive GDP, a strong economy, and robust, and reliable energy under the watchful eye of the Electric Reliability Council of Texas.. He predicts the state will be “well-positioned to win data center projects for years to come.”

The Top Four Texas Data Center Destinations

The city of Austin, Live Music Capital of the World

Austin is in the south-eastern quadrant of Texas. It is the fastest-growing and 11th most populous city in the United States, promising a steady supply of Texas data center clients. Their storage providers find the low unemployment rate and high job growth attractive, and there are many new business opportunities among small startups and large companies.

Many data center operators choose sites in the 550-acre Met Business Park in the southeast of the City of Austin. Furthermore, its central position in the state lowers the risk significantly of natural disasters.

Austin’s position in the transition belt between dry deserts and green, humid regions provides the long hot summers and short winters for which Gens Y and Z yearn. Being on the extreme edge of Tornado Alley means there are far fewer tornadoes than further to the north. However, thunderstorms are common and these can cause flash flooding.

Taken together, the City of Austin is a good destination. But is it the best Texas data center?

Austin: Market Profile

CBRE provides insights on the market in Austin. According to its research, Austin continues to be of interest to both hyperscalers and AI providers.

Developers in particular are focused on Austin’s suburbs, due to the availability of land. At present, growth is occurring both north and south of the Austin metropolitan area.

CBRE analysts found that under-construction activity totaled 463.5 MW in H1 2024, up from 88 MW in H2 2023. The overall vacancy rate remains at a record-low 1.8%, while under-construction capacity is 96% preleased.

Find out more about pre-leasing our Austin data center here.

San Antonio, AKA Military City USA

San Antonio is another strong contender for the best Texas data center location in the Lone Star State. It is located to the southeast of Austin, and half the distance from the Gulf of Mexico. It has fallen back slightly from its position of fastest-growing of the top ten largest cities in the United States in 2010. However, it still has the fourth-largest GDP in Texas.

San Antonio’s primary industries are military, health care, government-civil service, financial services, oil and gas, and tourism. It has a significant number of call centers and is a growth node for automobiles. It hosts five Fortune 500 companies and boasts a thriving business culture.

The vibrant city is 250 miles south of the Dallas / Fort Worth corridor, and 190 miles west of Houston. It enjoys a similar climate to the City of Austin. It has however been prone to flooding in the past, and receives occasional tornados within the city limits. Does this make San Antonio the right place to build a data center? It could be, but there are two more contenders.

San Antonio: Market Insights

San Antonio continues to attract the attention of hyperscalers and AI providers. Prices have risen throughout the area as land continues to be in short supply. San Antonio has an overall vacancy rate of 1.8% (a record low), with CBRE insights reporting that under-construction activity totaled 463.5 MW in H1 2024, up from 88 MW in H2 2023.

The Vast Dallas / Fort Worth Metroplex

Dallas and Fort Worth are north of the city of Austin, and border on Oklahoma. It is the largest inland metro in the United States and the economic/cultural hub of North Central Texas. Its 7.4 million residents contribute to the fourth-largest economy in the country and the eleventh-largest in the world.

No wonder so many enterprises cluster here in the banking, commerce, telecommunications, technology, energy, healthcare / medical research, and transportation/logistics industries. A number of electronics, computing, and telecommunication firms such as Microsoft, Texas Instruments, HP Enterprise Services, and Dell Services have also made it their home.

The metro is set in prairie land with occasional rolling hills. The climate is humid subtropical, meaning summers are pleasant but winters cooler. Heavy rainfall may occur, although historic floods have been curtailed. Dallas itself is in the lower end of Tornado Valley, causing extreme weather events in 2012 and 2015. This could be the ideal Texas data center choice but wait, we have one more.

Dallas-Ft. Worth: Market Insights

Total inventory in the Dallas – Ft. Worth area increased by 4.5% to 591.0 MW in the first half of this year. Meanwhile, preleasing hit a record-high 94.5% of MW under construction.

CBRE insights revealed that a strong preleasing and a shortage of available supply drove price increases across all requirements.

Demand from hyperscalers and AI providers continues to be high throughout Dallas and Ft. Worth. There has been a marked increase in land inquiries and power requests to the local utility company, and land prices too are on the rise here.

Learn more about pre-leasing our Dallas data center here.

The City of Houston, Space City

Houston is 200 miles west of San Antonio and completes our set of the four most desirable Texas data centers locations. With so many choosing it, it’s important to understand why it is so high on their list of priorities. Well, first it is the most populous city in the Southern United States. Its economy is thriving on the back of energy, aeronautics, and biomedical research.

Pioneers founded Houston in a marshy area. However, there are numerous well-drained higher-lying areas suitable for data centers. Summers are long, hot, and dry, while winters are mild. The city is south of Tornado Alley, although spring thunderstorms occasionally seed tornadoes.

Houston data centers have been building high wind-load rates into their facilities for years, to counter the force of hurricanes sweeping up from the Gulf.

On August 29, 2017, Houston Business Journal reported back on this, noting many data centers emerged unscathed. The city also came to the fore with timely advice on how Houston entrepreneurs could get back on their feet. It is worth noting that, while larger in scope, Hurricanes are generally much less powerful/locally destructive than tornados, provided that you are sufficiently inland from storm surge and isolated from flood plains. We also gain the great benefit of days of preparation versus tornados with perhaps only moments’ notice of warnings.

We are building for the ‘big one’ to enable us to avoid the chaos Hurricane Michael caused when it swept through Florida causing storm damage in Georgia and the Carolinas. Our data center was still under construction at the time when Harvey swept through. We stood up well and our power supply was uninterrupted throughout.

The city’s real strength that could make it a clincher is its mature, diverse business culture. It has small, medium, and large data-driven businesses in energy, manufacturing, aeronautics, and transportation. Moreover, it leads to health care. No wonder it boasts the second-largest number of Fortune 500 companies within its city limits.

Moreover, the Greater Houston Partnership is alive with business-savvy support, and a proven track record of supporting new business initiatives. This is one of the reasons so many data centers choose Houston compared to other options. The best way to decide if this is the Texas data center for you is to come and see for yourself.

Houston: Market Profile

CBRE has released insights on the market profile in Houston. Demand from the oil and gas industry continues to be high in Houston, while second-generation and legacy space is returning to the market.

A major operator plans to deliver 9 MW of additional capacity over the next 18 months in the Houston area. According to CBRE research, the overall vacancy rate in Houston fell to 14.4% in H1 2024 from 19.7% in H2 2023.

Learn more about our Houston data center here.

Fully managed colocation with TRG

Home to major interconnectivity hubs like Dallas, and new tech epicenter Silicon Hills, Texas is fast becoming one of the country’s most attractive spots for technology companies.

Attracted by low energy prices, great access to resources, a low cost of living and fantastic local talent, increasing numbers of businesses are now making the move to data centers like ours, in the heart of Texas.

If you’re tempted by a move to Texas, just give our team a call. With our fully managed service, we can look after the entire process on your behalf. All you need to do is pack up your equipment and send it over to us, and our team will do the rest. Contact us to find out more about Colo+ and how it works.

Looking for colocation?

For an unparalleled colocation experience, trust our expert team with three generations of experience